Euro advances on weaker dollar; bullish bias above daily cloud base

The Euro started trading on Monday with approx. one full figure opening higher, following fresh weakness of the dollar, additionally hit by crisis over collapse of Silicon Valley Bank last Friday.

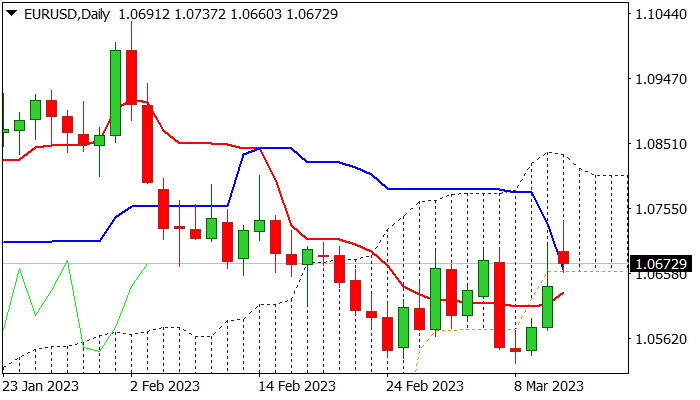

Bulls peaked at 1.0737, the highest since Feb 15) in Asian trading, but lost traction in European session.

Near-term price action is so far holding within daily Ichimoku cloud, which was penetrated after gap-higher opening and cloud base (1.0661) now marking solid support which is containing dips for now.

Improving daily techs, on rising 14-d momentum now in positive territory and north-heading RSI above neutrality zone, support near-term action, although bulls faced headwinds at pivotal 1.0718 barrier (55DMA / Fibo 38.2% of 1.1032/1.0524).

Sustained break here would reinforce near-term bulls and open way for further retracement of 1.1032/1.0524 bear-leg, with targets laying at 1.0778/1.0838 (Fibo 50% and 61.8% respectively).

Today’s close above daily cloud base is seen as a minimum requirement to keep fresh bulls in play.

Conversely, return and close below cloud base, would make the downside more vulnerable of renewed attack at key support at 1.0524 (Mar 8 low) and unmask next pivotal support at 1.0460 (Fibo 38.2% of 0.9535/1.1032 rally).

Traders focus on US inflation report on Tuesday and ECB’s policy meeting on Thursday, as key events this week.

Res: 1.0718; 1.0778; 1.0803; 1.0838

Sup: 1.0661; 1.0613; 1.0574; 1.0541