Euro breaks four-day range floor after downbeat PMI data

The Euro extended weakness through 1.08 handle and hit two-week low (1.0784) on Thursday.

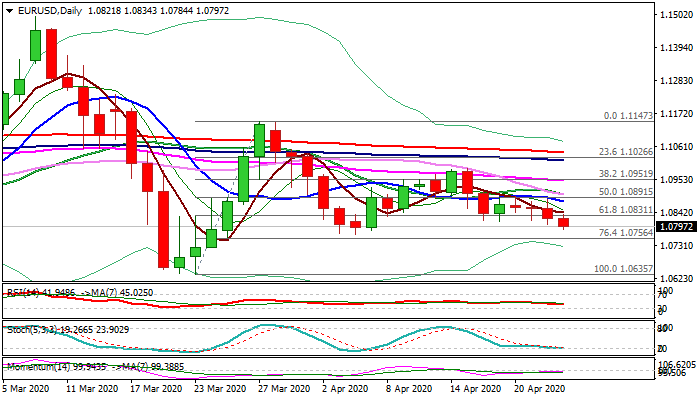

Near-term structure weakened after Wednesday’s eventual close below important Fibo support at 1.0831 (61.8% of 1.0635/1.1147 upleg) which generated initial signal of breaking out of sour-day range (1.0811/1.0896).

Downbeat PMI data from France, Germany and EU, which showed the depth of negative impact of coronavirus crisis on manufacturing and services sectors, added pressure to the single currency.

Markets now turn focus towards today’s meeting of EU leaders in attempts to agree the way of financing the economy of the bloc after pandemic.

Fresh bears pressure next pivotal levels at 1.0768 (6 Apr low) and 1.0756 (Fibo 76.4%), loss of which would open way for extension towards key support at 1.0635 (23 Mar new three-year low).

Broken Fibo 61.8% support at 1.0831 now reverted to strong resistance which is expected to cap and maintain bearish tone.

Res: 1.0831; 1.0841; 1.0877; 1.0896

Sup: 1.0784; 1.0768; 1.0756; 1.0700