Euro eases after strong rejection at key Fibo barrier

The Euro holds in red and eases in European trading on Monday as dollar is regaining traction after being hit by fresh risk-off mode on attack on Saudi oil installations during the weekend.

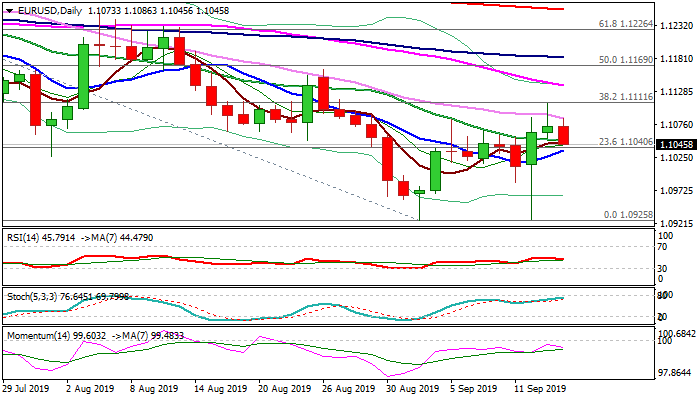

Strong two-day bounce from Thursday’s post-ECB spike low (1.0925) stalled just under pivotal Fibo barrier at 1.1111 (38.2% of 1.1412/1.0925) and returned below cracked bear-trendline (drawn off 1.1412 high), forming Shooting star pattern that maintains near-term pressure.

Fresh extension lower penetrated thick hourly cloud (1.1052/18), focusing pivotal supports at 1.1039/35 (Fibo 38.2% of 1.0926/1.1109 / 10DMA) and 1.1018 (hourly cloud base), loss of which will be bearish.

Weaker momentum and stochastic approaching overbought zone on daily chart, support scenario, however, near-term action remains supported by Thursday’s long-tailed candle, formed after strong downside rejection, which may slow the pullback.

Res: 1.1078; 1.1086; 1.1111; 1.1138

Sup: 1.1035; 1.1018; 1.1000; 1.0985