Euro extends recovery before bears regain control

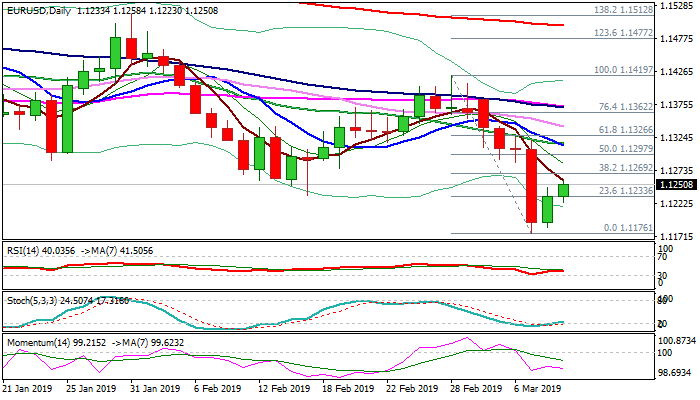

The Euro extends recovery from new 2019 low (1.1176, posted last Thu) on Monday, as greenback remains at the back foot from downbeat US NFP data.

However, current move is seen as corrective action of broader downtrend, as ECB’s dovish stance weighs heavily.

The single currency ended last week with loss of 1.3% (the biggest weekly fall since early Aug) after cracking key Fibo support at 1.1186 (61.8% of 1.0340/1.2555), clear break of which would generate bearish signal of larger downtrend from 1.2555.

Strong bearish momentum on daily chart favoring further weakness, upticks could be seen as fresh selling opportunities.

Solid double-Fibo resistance at 1.1270 (38.2 of 1.1419/1.1176 / 23.6% of 1.1570/1.1176) should ideally cap upticks before bears regain traction.

Only close above converged 10/20 SMA’s (bear-cross at 1.1315) would sideline immediate downside risk.

Res: 1.1258; 1.1270; 1.1298; 1.1326

Sup: 1.1223; 1.1186; 1.1176; 1.1098