Euro falls to two-month low vs dollar as bears gain pace

The Euro extends fresh bear-leg after ending a brief consolidation and hit two-month low in European session on Thursday.

Rising dollar on expectations that the Fed would remain in a hawkish mode and debt ceiling uncertainty, keep the single currency under pressure, while signals that German economy was in recession in the first quarter of 2023, added to negative outlook.

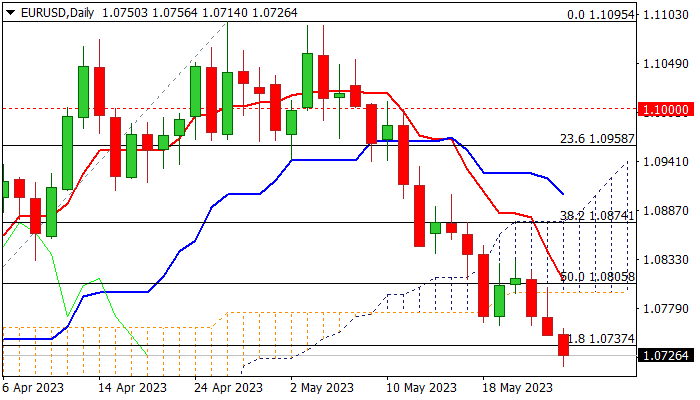

Fresh bears broke through pivotal Fibo support at 0.7374 (61.8% of 1.0516/1.1095 rally) with daily close below this level to confirm signal and open way for test of targets at 1.0700/1.0652 (psychological / Fibo 76.4%).

Rising bearish momentum and pressure from thickening daily cloud above the price, contribute to bearish signals, which are likely to be partially offset by opposite signals from deeply oversold stochastic.

Consolidation would just provide better selling opportunities, as overall picture is bearish and fundamentals were so far negative for the euro, with upticks to be capped under key 1.0800 resistance zone (daily cloud top / falling 10DMA).

Res: 1.0772; 1.0800; 1.0831; 1.0874

Sup: 1.0700; 1.0652; 1.0631; 1.0600