Euro holding steady after Thursday’s bounce, key barriers at 1.08 zone in focus again

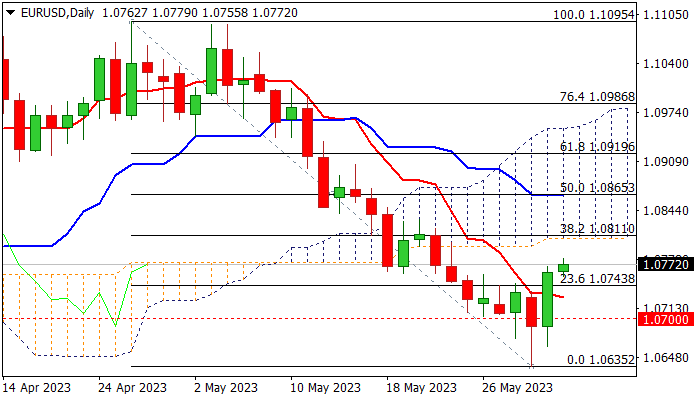

Near-term focus shifted higher following Thursday’s strong bounce on repeated failure under 1.07 support, which formed bullish engulfing pattern on daily chart and confirmed a bear-trap under 1.0652 Fibo support

The Euro hit one-week high vs dollar in early Friday’s extension of 0.7% advance on Thursday, as fading US default fears after the Congress approved debt limit suspension, offset expected negative impact on Euro from lower than expected EU May inflation.

All eyes are on today’s release of US labor report, which is expected to provide fresh direction signals.

US non-farm payrolls are forecasted at 180K in May vs 253K previous month, unemployment is expected to rise to 3.5% in May from 3.4% in April and average hourly earnings to ease to 0.4% m/m from 0.5%.

Forecasts signal that US job growth likely slowed in May (although the labor market remains tight overall) which may ease pressure on Fed and possibly allow the policymakers to skip an interest rate hike this month.

In such scenario pressure on dollar would increase and that would open way for Euro’s further recovery.

Technical picture on daily chart improved, though fresh advance needs more signals to bring bulls firmly in play, as the price broke above initial resistance at 1.0744 (10DMA / Fibo 23.6% of 1.1095/1.0635 bear-leg) but 14-d momentum remains in the negative territory and turning lower, stochastic is touching the borderline of overbought zone and converged 20/100 DMA’s are about to form a bear-cross, reinforcing key barriers at 1.0805/11 zone (daily cloud base / Fibo 38.2% of 1.1095/1.0635 / converged 20/100DMA’s).

Firm break here is needed to signal reversal and spark further recovery, while failure would generate initial signal of recovery stall and keep the downside vulnerable.

Res: 1.0805; 1.0811; 1.0865; 1.0919

Sup: 1.0743; 1.0700; 1.0652; 1.0631