Euro holds in directionless mode; US jobs data/ US-China trade conflict in focus for fresh signals

The Euro ticked higher in early European trading but remains directionless and looking for fresh signals.

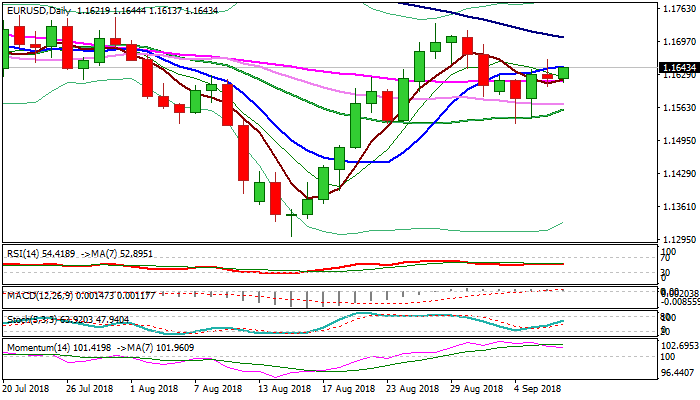

Thursday’s long-legged Doji candle signaled indecision, as the pair faces strong headwinds from thin daily cloud, but the downside remains protected by 55SMA for now.

Conflicting daily indicators (momentum is weakening while slow stochastic continues to trend higher and MA’s are turning to bullish configuration) lack clearer direction signal.

EU GDP data mark key event of the European session, with expectations for unchanged figures in Q2.

More significant US jobs data, due in early US session, are eyed for stronger signals.

According to the forecasts, US job growth is expected to pick up in August, with 191K jobs created in August, compared to 157K in July. Also, unemployment rate is expected to fall to 3.8% (18-year low) from 3.9% previous month.

Average hourly earnings are expected to rise 0.3% in August, unchanged from the previous month.

Trade conflicts between the US and China, as well as other major economies, such as Canada, Japan and European Union, maintain high tensions in the markets and could also trigger stronger action is the situation escalates.

Res: 1.1644; 1.1662; 1.1678; 1.1714

Sup: 1.1616; 1.1595; 1.1569; 1.1558