Gold maintains firm tone; stronger rally on trade concerns / emerging mkts crisis not ruled out

Spot Gold benefited from weaker dollar on Thursday and extends recovery from $1189 (04 Sep low) into second day.

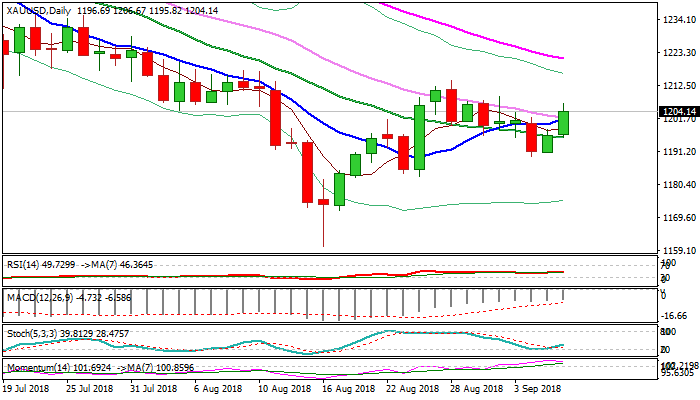

Fresh bullish acceleration broke above psychological $1200 barrier, reinforced by 10SMA and probed above $1204 pivot (Fibo 61.8% of $1214/$1189 bear-leg).

Daily close above $1204 is needed to confirm higher low at $1189 and unmask key near-term barrier at $1214 (28 Aug high).

Bullishly aligned daily techs are supportive, with the yellow metal being boosted by persisting concerns about US/China trade conflict, which could escalate and spark stronger safe-haven buying.

Worsening situation in emerging markets, with Turkey, Argentina and South Africa, being currently in focus, could also strongly underpin gold price for further recovery of larger $1365/$1160 Apr/Aug fall.

Sustained break above $1214 pivot (reinforced by falling weekly 10SMA) would open way towards $1225/27 (Fibo 61.8% of $1265/$1160 bear-leg / base of falling daily cloud).

Broken 10SMA marks initial support ($1201), with deeper dips expected to find support above 20SMA ($1195).

Res: 1206; 1209; 1214; 1217

Sup: 1201; 1195; 1189; 1183