Euro pressures pivotal support as risk mode fades on rising geopolitical tensions

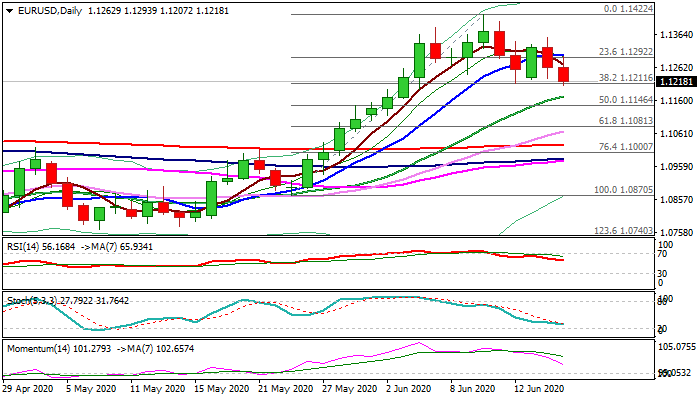

The Euro remains in red for the second day and retests pivotal 1.1212 support, threatening of break lower that would signal reversal.

Fresh move into safer assets due to rising geopolitical tensions pressure Euro, while US hosing starts below expectations in May slightly softened dollar but the impact was minor.

Falling daily momentum, stochastic and RSI, along with formation of 5/10DMA bear-cross and break below thick 4-hr cloud, weigh on near-term action.

Bears look for eventual break of 1.1212 (Fibo 38.2% of 1.0870/1.1422 / 12 June low) support that would open way for deeper correction towards 1.1171 (rising 20DMA) and 1.1146 (50% retracement).

Ability to hold above 1.1212 pivot would keep the pair’s price in extended congestion but near-term bias is expected to remain negative while 10DMA (1.1298) caps.|

Res: 1.1254; 1.1298; 1.1353; 1.1383

Sup: 1.1200; 1.1171; 1.1146; 1.1081