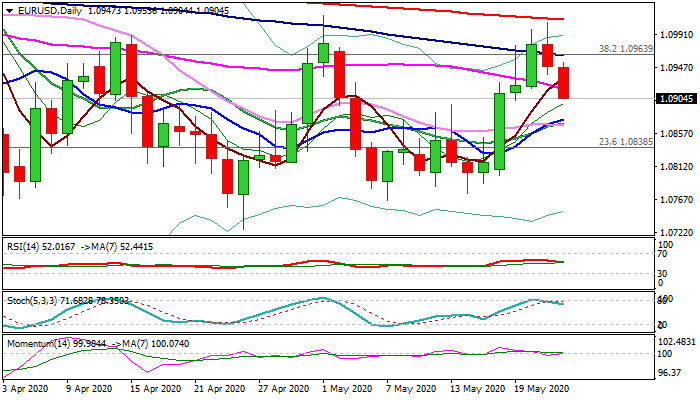

Euro remains within larger range after failure at 1.10 resistance zone

The Euro is holding in red for the second day and emerges below the base of thickening daily cloud base (1.0931) in early European trading on Friday.

Fresh weakness followed another upside rejection at 1.10 zone (recovery was capped by 200DMA) signaling that the pair remains within larger 1.0770/1.10 range (since early Apr).

Near-term focus turns lower as reversal pattern is developing on daily chart, with converged 10/20/30 DMA’s (at 1.0870 zone) marking next target, break of which would further weaken near-term structure.

Stronger dollar on rising US/China tensions adds pressure on the single currency.

Key levels are daily cloud base and 55DMA (1.0917) and today’s close below these levels would confirm bearish stance.

Caution on close within the cloud and extension above 100DMA (1.0963) as this would keep the action in the upper end of the range and risk fresh attack at 1.10 zone.

Res: 1.0917; 1.0931; 1.0963; 1.1000

Sup: 1.0891; 1.0870; 1.0830; 1.0800