Euro rises on modest US CPI data but bias is expected to remain bearish below 1.1931/52 barriers

The Euro rose in early US trading on Wednesday after US inflation data for February failed to surprise, coming mainly in line with expectations that deflated dollar.

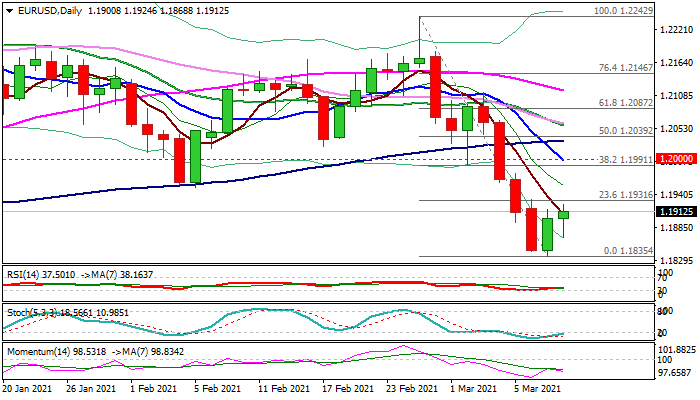

Fresh extension of Tuesday’s 0.46% jump adds to initial signals of reversal, but bulls need lift and close above pivotal barriers at 1.1931/52 (Fibo 23.6% of 1.2742/1.1835 / Feb 5 low) to tighten grip and open way for stronger correction of 1.2742/1.1835 fall that would expose psychological 1.20 barrier.

Daily cloud twist (1.2107) may attract for further advance, but negative daily tech, despite oversold stochastic, warn of limited recovery before larger bears resume.

Near-term bias is expected to remain bearish while the action remains capped under 1.1931/52 pivots and keep in play risk of final attack at rising 200DMA (1.1820).

Res: 1.1931; 1.1952; 1.1976; 1.2000

Sup: 1.1887; 1.1868; 1.1835; 1.1820