Euro surges on post-ECB comments / weaker than expected US CPI data

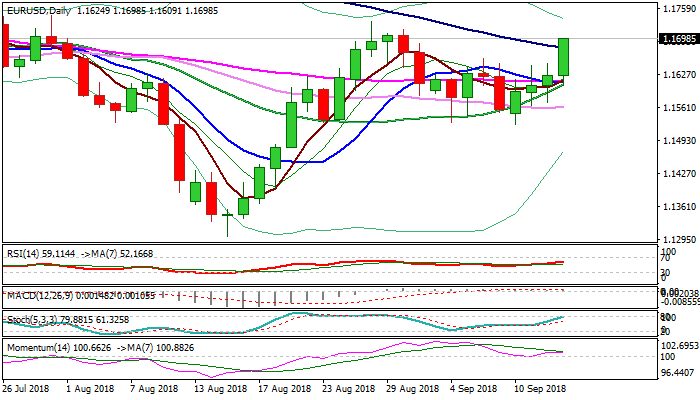

The Euro accelerated higher and eventually broke above multiple upside rejections at 1.1650 and extended gains above top of thin daily cloud.

Fresh rally was sparked by comments from the ECB chief Draghi in post-policy meeting press conference and also inflated by weaker than expected US inflation numbers.

The European central bank made no surprise, keeping interest rates unchanged, with next hike expected in the second half of 2019 and staying on track to start winding down bond purchases by the end of this year.

But some comments from Mario Draghi were seen as hawkish and boosted the single currency.

Draghi expects underlying inflation to pick up towards the end of the year and continue to gradually increase over the medium term.

Growth rates showed increase above expectations, with risk surrounding zone’s growth outlook, being broadly balanced.

Draghi also highlighted that broad-based expansion of the Eurozone economy goes along with previous estimations and inflation continues to gradually rise.

In addition, data released today showed that US CPI rose less than expected in August. Annualized figure showed inflation rose 2.7%, falling under forecast at 2.8% and previous month’s 2.9%.

Monthly figure stayed unchanged at 0.2% from the previous month, but undershot forecast for 0.3% increase.

Downbeat US data weakened the greenback, offering fresh tailwind to the single currency.

Bulls extended through falling 100SMA (1.1681), opening way for retest of key barriers at 1.1733 (28 Aug high); 1.1750 zone (17/31 July lower platform, formed after multiple upside rejections) and 1.1780 (Fibo 38.2% of 1.2555/1.1300 Feb/Aug fall).

Bulls need confirmation on close above daily cloud top / 100SMA.

Res: 1.1718; 1.1733; 1.1750; 1.1780

Sup: 1.1681; 1.1649; 1.1614; 1.1606