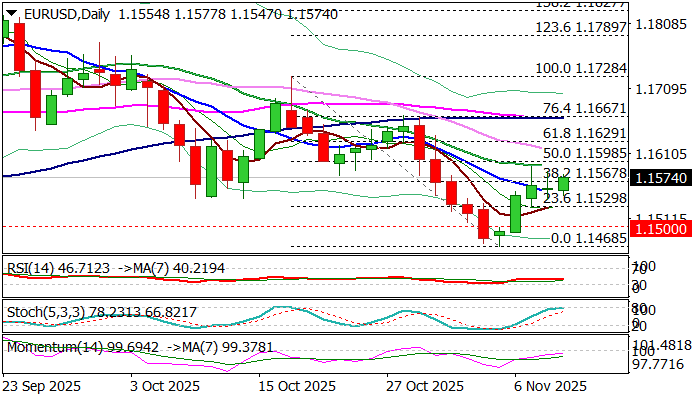

EURUSD attempts again through important Fibo barrier

The Euro remains constructive and probes again through cracked Fibo resistance at 1.1570 (38.2% of 1.1728/1.1468 descend), as recovery leg from 1.1468 was boosted by formation of bear-trap on weekly chart (under Kijun-sen).

Repeated failure here in last two sessions (upticks were capped by 20 DMA and repeatedly failed to register close above this level) point to significance of the barrier.

Mixed technical signals (55/200DMA death-cross is forming at the upside and weighs along with still negative momentum and stochastic about to enter overbought territory) while formation of 5/10 bull-cross partially counters negative signals.

The dollar remains at the back foot against its major counterparts on fresh expectations of Fed rate cut (economists are optimistic about the condition of the US economy and inflation) though a series of delayed economic data are to be released as soon as the US government reopens, that would provide clearer picture.

We look for initial signal on reaction at 1.1570 pivot, with close above to brighten outlook and open way for attack at next significant barriers at 1.1590/98 (20DMA / Fibo 50%), violation of which to signal bullish continuation and expose targets at 1.1630 (Fibo 61.8%) and 1.1655 (daily cloud base.

Caution on repeated failure at 1.1570 Fibo level, though bullish bias expected to remain while the price holds above 10DMA (1.1543).

Better than expected results from Eurozone November ZEW economic sentiment likely to provide some support to the single currency.

Res: 1.1590; 1.1611; 1.1630; 1.1667

Sup: 1.1543; 1.1500; 1.1446; 1.1391