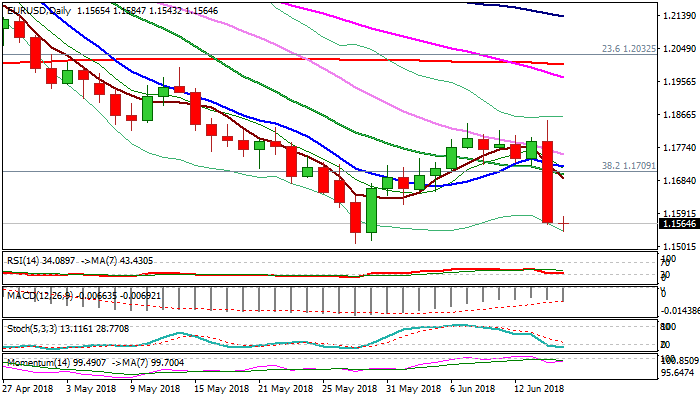

EURUSD – bears eye key support at 1.1509 after Thu’s 2% fall; correction may precede attack

The Euro remains in red on Friday and extends weakness from the previous day when it fell 2% on dovish ECB.

Thursday’s fall marked the biggest one-day loss in two years and bears eye key support at 1.1509 (29 May low), following yesterday’s close below the last obstacle at 1.1589 (Fibo 76.4% of 1.1509/1.1848 recovery leg).

Daily tech returned to full bearish configuration and support further weakness, boosted by bearish sentiment which further soured on ECB’s announcement of keeping QE for the rest of the year and seeing no changes in the interest rates until the second half of 2019.

Expectations for attempts through 1.1509 pivot are rising and sustained break here would open way for extension of broader downtrend from 2018 high at 1.2555 towards targets at 1.1447 (50% retracement of 1.0340/1.2555 (Jan 2017 / Feb 2018 rally) and 1.1414 (weekly 200SMA).

Bears are expected to face strong headwinds at 1.1509 support and may correct higher before final attack.

Offers at 1.1650/1.1700 zone are seen as good levels for fresh shorts and should keep the upside limited.

Only close above 1.1700 (20SMA) would sideline bears.

Res: 1.1584; 1.1650; 1.1700; 1.1717

Sup: 1.1543; 1.1509; 1.1447; 1.1414