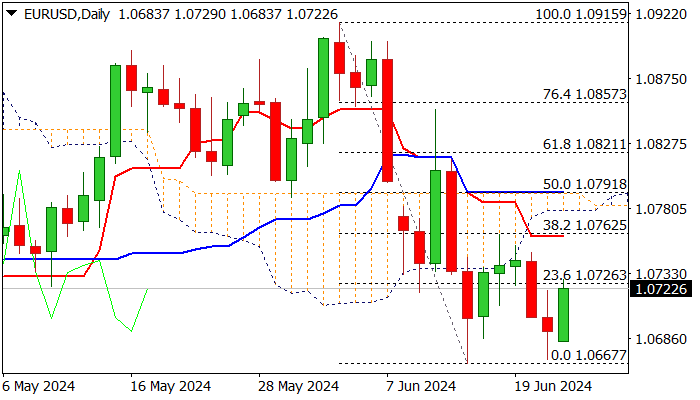

EURUSD – bounce needs to clear 1.0760 barrier to signal stronger correction

EURUSD bounces on Monday, as traders collect profits from Thu/Fri fall.

The single currency regained traction despite weaker than expected German Ifo data, as sentiment improves on growing expectations on ECB rate cut, following recent weak economic data.

Markets shift focus to US PCE data and French election, due this week and expected to generate fresh signals.

Formation of a double-bottom at 1.0670 zone on daily chart and likely bullish engulfing, generate initial signal, along with magnetic daily cloud twist on Wednesday.

However, the downside is expected to remain vulnerable as long as current bounce stays below upper pivots at 1.0760 zone (daily Tenkan-sen / Fibo 38.2% of 1.0915/1.0667), as 14-d momentum is deeply in negative territory and adds to warning of limited correction of larger downtrend.

Firm break through 1.0760/80 zone is needed to ease downside risk, though a number of strong barriers lays above and would make recovery attempts more difficult.

Res: 1.0731; 1.0760; 1.0785; 1.0800

Sup: 1.0700; 1.0667; 1.0649; 1.0624