EURUSD – bulls firmly hold grip above rising daily cloud

EURUSD jumped on Wednesday, extending post-NFP recovery leg which paused in past two days after sharp rally last Friday.

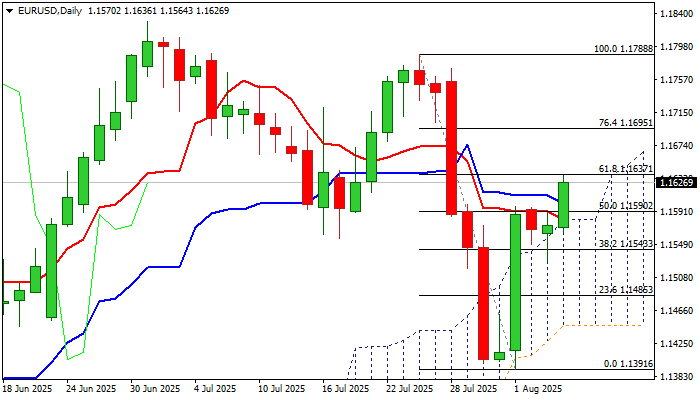

Bulls resumed after consolidation, to hit one-week high and marking almost 61.8% retracement of 1.1788/1.1391 drop, as dollar lost traction on growing signals of more dovish stance from Fed amid unexpected weakness in the US labor sector.

Markets were also nervous about President Trump’s decision about new Chair parson of the US central bank, with dominant negative tone surrounding the US currency.

Daily studies firmed further as 14-momentum broke into positive territory while near-term price action holds above ascending daily Ichimoku cloud top (1.1581) and nearby rising 55DMA (1.1568) which continue to protect the downside for the fourth consecutive day and underpin near-term action.

Fresh acceleration higher needs to register daily close above cracked barriers at 1.1626/37 20DMA / Fibo 61.8%) to further strengthen near-term structure and open way for test of net targets at 1.1695/1.1700 (Fibo 76.4% / psychological).

However, overbought Stochastic warns that bulls may face headwinds, with action required to stay above cloud to keep near term bias with bulls.

Res: 1.1637; 1.1667; 1.1700; 1.1721

Sup: 1.1610; 1.1581; 1.1568; 1.1527