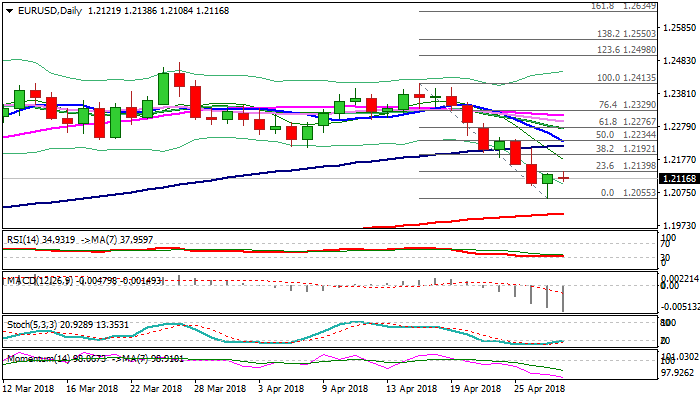

EURUSD consolidates above 1.2154 Fibo support; break above 1.22 zone to signal reversal and sideline existing risk of final attack at key 1.20 support

The Euro eased in early European trading on Monday after holding within narrow range in Asian, driven by weaker that expected German retail sales (Mar -0.6 vs 0.8% f/c) and eyeing German CPI data (Apr m/m -0.1% f/c vs 0.4% prev) for fresh signal.

The price bounced from dangerous zone on Friday, following strong rejection at 1.2054 (Fibo 50% of 1.1553/1.2555 rally), which left Hammer candle, signaling that steep descend from 1.2413 (17 Apr high) might be running out of steam and basing attempts.

Daily slow stochastic is emerging from oversold territory and supports scenario, however, downside risk persists, as daily techs remain in firm bearish setup and continue to build negative momentum.

Recovery attempts were so far capped by hourly cloud (spanned between 1.2123 and 1.2157) guarding next pivot at 1.2192 (Fibo 38.2% of 1.2413/1.2055), firm break of which is needed to ease downside pressure.

The pair would remain in extended consolidation while 1.2192 stays intact, with bearish bias in play for renewed probe through 1.2054 support and possible attack at key 1.20 support zone (psychological support / 200SMA).

Res: 1.2140; 1.2154; 1.2192; 1.2219

Sup: 1.2108; 1.2054; 1.2000; 1.1936