EURUSD continues to trend higher, on track for the biggest weekly gain in five years

The Euro rose above 1.08 level and hit the highest in four months on Thursday after ECB’s widely expected decision to cut interest rates by 25 bp to 2.5%, in its sixth rate cut since June.

The central bank stated that monetary policy is becoming meaningfully less restrictive and left the door open for further easing, repeating their standard phrase that future action will be depending on the incoming economic data.

The single currency holds in sharp bullish acceleration for the fourth consecutive day, underpinned by weakening dollar and the most significant factor, signals that Germany’s next government is to create a 500 billion euro fund to boost military and revive economic growth of the EU’s largest economy which is in recession for the second year.

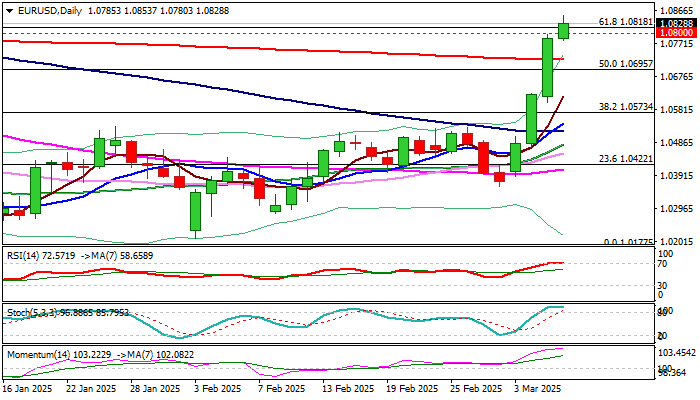

The latest sharp rally (EURUSD is on track for the biggest weekly gain since the third week of March 2020) has significantly improved technical picture on daily chart however, overstretched momentum and stochastic indicators suggest that bulls may start losing traction, which would prompt partial profit-taking.

Near-term outlook is expected to remain positive, as the action is underpinned by strongly favorable fundamentals and bullish technical studies, with likely scenario of limited dips (to be ideally contained by 200DMA / broken Fibo 50%) to offer better levels to re-join bullish market for extension towards 1.0872 (200WMA) and 1.0969/1.1000 targets (Fibo 76.4% of 1.1214/1.0177 / psychological) in extension.

Res: 1.0853; 1.0872; 1.0900; 1.0969

Sup: 1.0800; 1.0725; 1.0695; 1.0630