EURUSD dips to the lowest in over six months on weak German data and firmer dollar

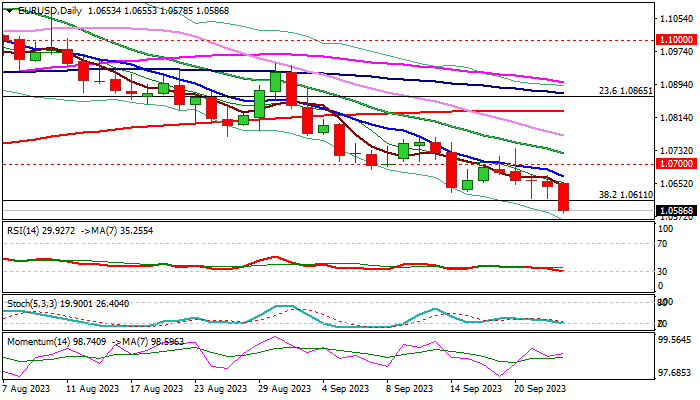

EURUSD came under renewed pressure in mid-European / early US trading on Monday and broke through pivotal support at 1.0611(Fibo 38.2% of 0.9535/1.1275 rally), after bears were repeatedly rejected last Thu/Fri.

Fresh weakness signals continuation of larger downtrend, which was paused for consolidation in past six days, with bearish signal being generated on break of 1.0611 pivot (confirmation of signal requires daily close below here.

The pair is trading at the lowest in 6 ½ months and bears eye next strong support at 1.0553 (weekly cloud top).

Stronger headwinds could be expected in this zone as ascending weekly cloud is thickening and stochastic and RSI indicators are entering oversold territory on daily chart.

Although bears still firmly hold grip on all timeframes and there are no any signs of reversal so far, some price adjustment should be anticipated in coming sessions.

Upticks are likely to be limited and not to exceed falling 10DMA (1.0670) to keep bears intact.

Penetration of weekly cloud to expose targets at 1.0405 (50% retracement) and 1.0284 (weekly cloud base, in extension).

Res: 1.0611; 1.0642; 1.0670; 1.0700

Sup: 1.0553; 1.0483; 1.0405; 1.0290