EURUSD extends lower; EU PMI and FOMC minutes could further pressure the pair

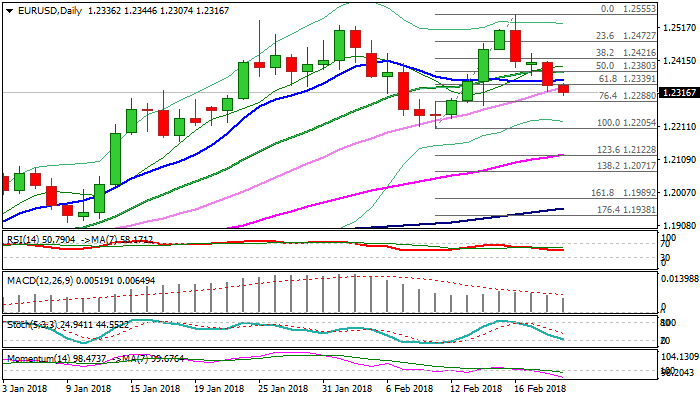

The Euro continues to trend lower from 1.2555 spike high / strong upside rejection and pressures psychological support at 1.2300, in extension on previous day’s strong fall which generated bearish signal on close below 1.2339 (Fibo 61.8% of 1.2205/1.2555 upleg).

Tuesday’s long bearish candle and descending thick hourly cloud continue to weigh on near-term action, with 10/20SMA’s in bearish setup and 14-d momentum in steep descend, deeply in negative territory, adding to negative outlook.

Break below 1.2300 handle and 1.2288 (Fibo 76.4%) would open way towards pivotal supports at 1.2205 (09 Feb correction low) and 1.2172 (Fibo 38.2% of larger 1.1553/1.2555 ascend), loss of which would generate strong bearish signal.

German PMI data fell below expectations in Feb with EU Manufacturing PMI forecasted at 59.2 in Feb vs 59.6 in Jan and Manufacturing PMI forecasted at 57.7 in Feb vs 58.0 in Jan, expected to add to existing pressure on downbeat releases.

FOMC minutes are also in focus, with hawkish tone from the US central bank expected to further depress the single currency.

Res: 1.2344; 1.2360; 1.2380; 1.2412

Sup: 1.2300; 1.2288; 1.2235; 1.2205