EURUSD extends steep fall as political uncertainty sours the sentiment

EURUSD extends sharp fall into second straight day and trading near the lowest in 1 ½ month low on Friday.

Fresh risk aversion on growing political uncertainty in France, with tremors hitting the whole euro-bloc, put the single currency under strong pressure.

The pair lost 1.1% of its value in just two days, raising prospects for further weakness on deteriorating fundamental environment and bearish technical picture.

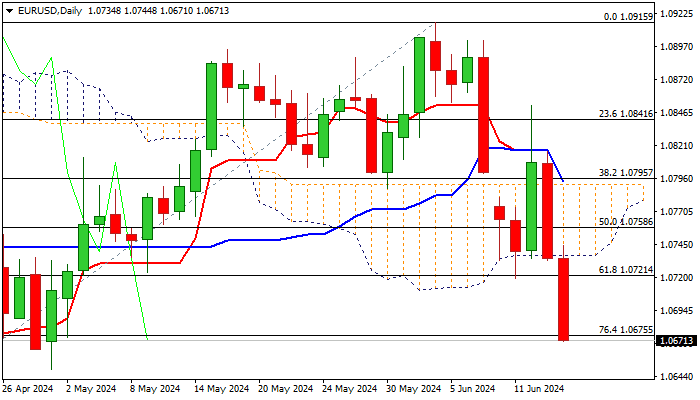

Two massive bearish daily candles (Thu/Fri) weigh, along with surge through daily cloud and close well below cloud base and Thursday’s bearish engulfing.

The pair is on track for the second consecutive weekly loss, with long upper shadows of the last two weekly candles, pointing to increased offers.

Strong negative momentum and MA’s in full bearish setup, also contribute to scenario.

Partial profit-taking should be anticipated after recent heavy losses, though upticks are expected to be limited, due to very negative sentiment and offer better selling levels.

Daily cloud base (1.0737) should ideally cap upticks.

Res: 1.0720; 1.0737; 1.0774; 1.0785

Sup: 1.0649; 1.0624; 1.0601; 1.0526