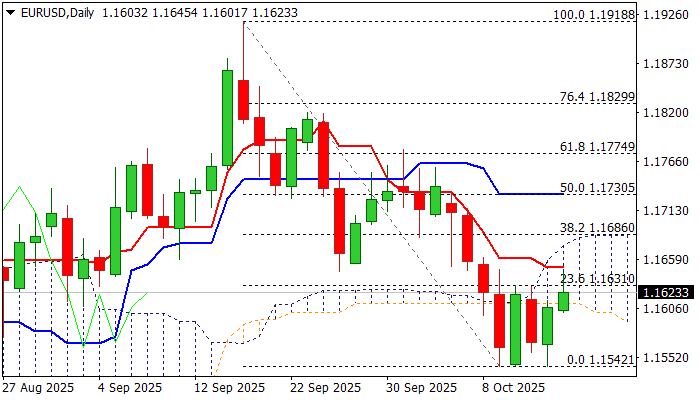

EURUSD – fresh recovery needs to close above daily cloud to brighten near-term outlook

The Euro edged higher on Wednesday morning, underpinned by weaker dollar on the latest remarks from Fed chief Powell which markets saw as more dovish and contributing to strong expectations for two rate cuts by the end of the year.

Fresh gains penetrated daily cloud (spanned between 1.1610 and 1.1686) and attempt to break above recent congestion (top lays at 1.1650 and is reinforced by daily Tenkan-sen), which acts as solid resistance and caps recovery so far.

Break of 1.1650 is seen as minimum requirement to keep recovery in play, with lift above daily cloud top (1.1680. also Fibo 38.2% of 1.1918/1.1542) to confirm signal and open way for further gains towards 1.1730 (daily Kijun-sen / 50% retracement) and 1.1774 (Fibo 61.8% / Oct 1 lower top) in extension.

However, predominantly bearish structure of daily technical studies warns of potential recovery stall, with slight bullish bias expected while the price stays above cloud base, but fresh negative signal to be expected in case on repeated daily close below daily cloud.

Res: 1.1650; 1.1686; 1.1700; 1.1730

Sup: 1.1610; 1.1596; 1.1574; 1.1542