EURUSD looks for fresh direction signals

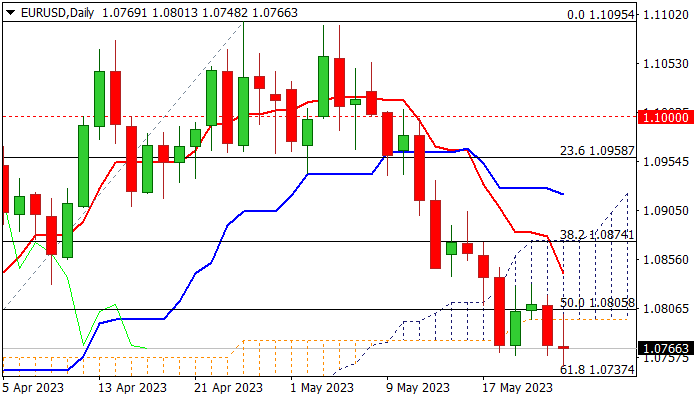

The Euro is holding within the range which extends into fourth consecutive day, pressured by the base of thickening daily cloud, but so far unable to clearly break through freshly established base at 1.0760 zone.

Near-term action remains biased lower, due to prevailing risk aversion, but looking for fresh direction signals.

The minutes of Fed’s last policy meeting is the key event today, as traders seek more information about the central bank’s interest rate path.

Also, results of debt ceiling talks are expected to impact pair’s performance.

Conflicting daily studies lack direction signal, with break of supports at 1.0760/37 (base / Fibo 61.8% of 1.0516/1.1095) to signal bearish continuation, while penetration of daily cloud (base lays at 1.0796) and extension through falling daily Tenkan-sen (1.0841) would generate initial reversal signal, which will require verification on lift above cloud top (1.0874).

The pair is on track for strong monthly fall in May and bearish engulfing is forming on monthly chart, which would add to negative outlook.

Res: 1.0796; 1.0841; 1.0874; 1.0921

Sup: 1.0737; 1.0700; 1.0652; 1.0631