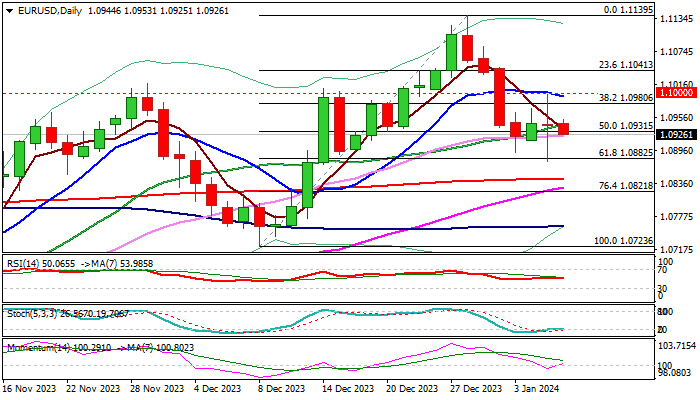

EURUSD – near-term action remains in sideways mode and looks for direction signals

Near-term action remains directionless and holding within the range which extends into fourth consecutive day.

Friday’s long-legged Doji, left after turbulent post-NFP action, contributes to sideways mode, along with mixed daily technical studies.

Moving averages are setup, though converging 55/200DMA’s are on track to generate bullish signal on potential formation of a golden cross.

Also, 14-d momentum broke into positive territory, the action remains underpinned by thick daily cloud and weekly bear-trap under 1.0931 Fibo support, adds to growing bullish signals.

However, signals need confirmation on lift above 1.10 zone (range top / psychological / daily Tenkan-sen) to confirm a higher base and shift near-term focus higher.

On the other hand, violation of range floor (1.0876) would weaken near-term structure and generate initial signal of continuation of larger downtrend from 1.1139 (Dec 28 peak).

Res: 1.0980; 1.1008; 1.1041; 1.1084

Sup: 1.0914; 1.0876; 1.0850; 1.0821