EURUSD pulls back after Wed’s strong upside rejection; dip-buying remains favored

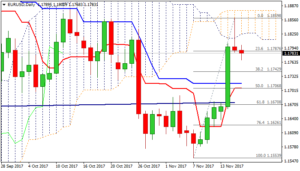

The Euro stands in red in early Thursday’s trading and extends lower after previous day’s strong upside rejection in the middle of daily cloud.

Failure to sustain break in the cloud and subsequent quick pullback formed Shooting Star pattern which suggests pullback.

Today’s easing confirms the scenario with dips expected to find solid support at 1.1740 zone (broken 100SMA / Fibo 38.2% of 1.1553/1.1859 upleg) which should ideally contain, as underlying bull-trend favors dip-buying before fresh attempts higher.

Extended pullback should hold above 1.1716/06 zone (converged daily Kijun-sen / Tenkan-sen) to keep bulls in play.

Near-term bias remains at the upside for final break above daily cloud (1.1877), reinforced by Fibo 61.8% of 1.2092/1.1553 descend, break of which is needed for strong bullish signal.

Traders are awaiting release of EU CPI data, which is key event for the Euro today and forecasted to stay within last month’s levels.

Res: 1.1800; 1.1836; 1.1859; 1.1877

Sup: 1.1768; 1.1740; 1.1716; 1.1706