EURUSD pulls back of fresh dollar’s strength; Powell, EU data in focus for fresh signals

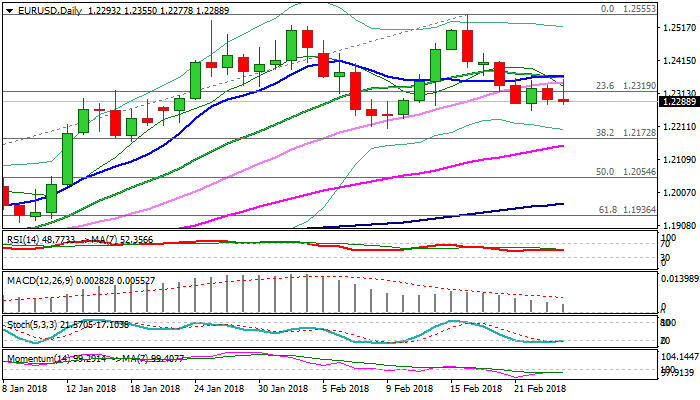

The Euro fell in early American trading on Monday and erased almost all gains of the day, after upside attempts were repeatedly capped at 1.2355 (top of four-day congestion).

The dollar rose across the board on Monday, pulling the single currency lower, with rather neutral tone (as widely expected) from the ECB chief Draghi, adding to negative near-term outlook.

Speech of new Fed Chair Powell, due tomorrow, is closely eyed and could trigger stronger action if Powell gives further signals about the next steps of the US central bank regarding monetary policy.

In addition, series of EU data are due this week, starting with inflation numbers and consumer confidence from various members of the bloc, followed by EU manufacturing and growth data, which could further impact Euro’s performance.

Downside surprise would put the single currency under increased pressure and may sideline broader longs on break below key supports at 1.2205/1.2173.

Bullish scenario requires initial signal on break above range ceiling at 1.2360, which would open way for stronger recovery of 1.2555/1.2259 fall.

Res: 1.2360; 1.2372; 1.2407; 1.2442

Sup: 1.2277; 1.2260; 1.2205; 1.2173