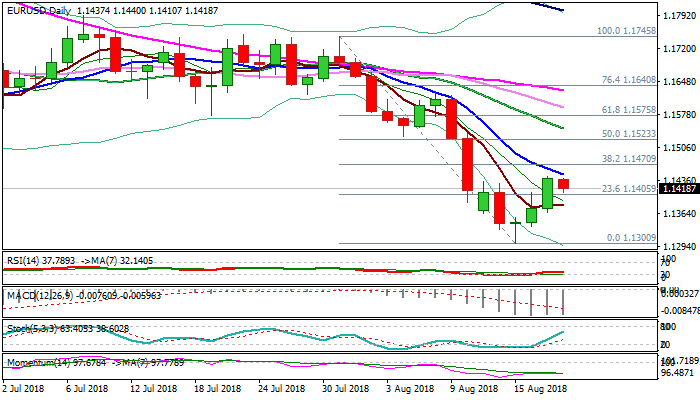

EURUSD – recovery rally shows signs of stall; overall structure remains bearish

The Euro holds in red in early Monday’s trading and pulled back from three-day recovery high at 1.1445.

Falling 10SMA caps recovery for now, keeping intact pivotal barrier at 1.1470 (Fibo 38.2% of 1.1745/1.1300) as bounce from last Wednesday’s low at 1.1300 (09 Nov 2016 high) shows signs of stall, with bearish daily techs supporting scenario.

The pair is riding on the fourth corrective wave of five-wave cycle from 1.1745 (31 July high), which should ideally end here, before broader bears continue.

Dip and close below 5SMA (1.1385) is needed to confirm and re-focus 1.1300 support, loss of which would open way towards 1.1186 (Fibo 61.8% of 1.0340/1.2555 rally).

Alternatively, break above 1.1470 Fibo resistance would signal extended recovery and expose very strong barrier at 1.1540 (base of weekly cloud, reinforced by Tenkan-sen line).

Res: 1.1445; 1.1470; 1.1509; 1.1540

Sup: 1.1410; 1.1385; 1.1366; 1.1335