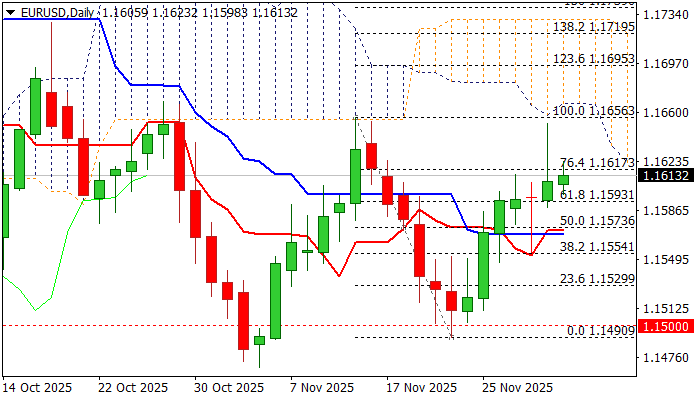

EURUSD remains constructive but thick falling daily cloud weighs

The Euro keeps firm tone on Tuesday after near-term recovery spiked to two-week high (1.1652) but subsequent quick pullback pointed to strong upside rejection (daily candle with long upper shadow).

Recovery stalled just under the base of daily Ichimoku cloud (1.1666) and left a bull-trap above 100DMA (1.1642) although near-term action still holds above broken Fibo 61.8% of 1.1656/1.1490 (1.1593), partially offsetting threats of reversal for now.

Near-term action remains bullishly aligned despite conflicting signals (55/100 bear-cross vs daily Tenkan/Kijun-sen bull-cross) though growing pressure from descending and thickening daily cloud, should be considered.

Bulls probe again through cracked Fibo level at 1.1617 (76.4%) with falling 55DMA (1.1628) and 100DMA (1.1642) guarding cloud base (1.1666) where headwinds could be expected again.

Violation of 1.1593 Fibo support to weaken near-term structure, with loss of 1.1570 support zone (broken Fibo 50% / converged daily Tenkan/Kijun-sen) to signal reversal.

Res: 1.1628; 1.1642; 1.1655; 1.1666

Sup: 1.1593; 1.1570; 1.1550; 1.1520