EURUSD stands at the front foot and extends recovery ahead of Fed

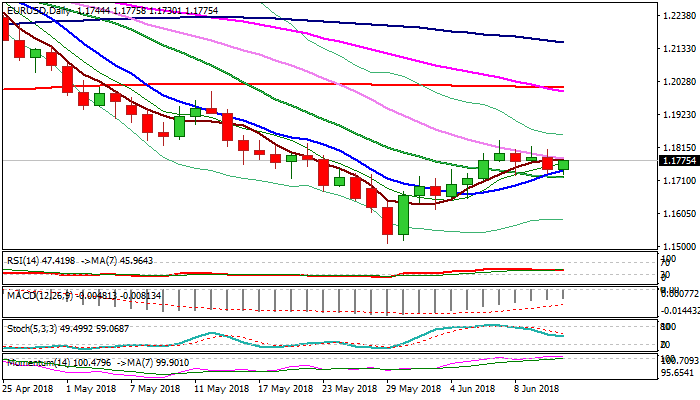

The Euro hits new session high in early US session trading on Wednesday, on extension of bounce from daily low at 1.1730, posted in late Asian session, where thick rising 4-hr cloud contained dips.

The single currency rallied despite weaker than expected EU IP data (Apr -0.9% vs -0.5% f/c and 0.6% in Mar) and returned above 10SMA (1.1740) which was cracked on short-lived dip to 1.1730.

Break and close above 30SMA (1.1781) which capped upside attempts in past four days, is needed to provide relief and shift near-term focus higher.

More likely scenario sees Euro lower on hawkish Fed, with upticks seen as positioning.

Bearish scenario requires close below 1.1721/13 pivots (20SMA / Fibo 38.2% of 1.1509/1.1839), to generate fresh bearish signal which could be boosted by dovish ECB tomorrow, for extension towards 1.16 zone.

Res: 1.1781; 1.1809; 1.1839; 1.1850

Sup: 1.1730; 1.1713; 1.1674; 1.1652