EURUSD surges on much weaker than expected US NFP numbers

EURUSD bounced sharply on Friday, with fresh strength being boosted by downbeat US labor data.

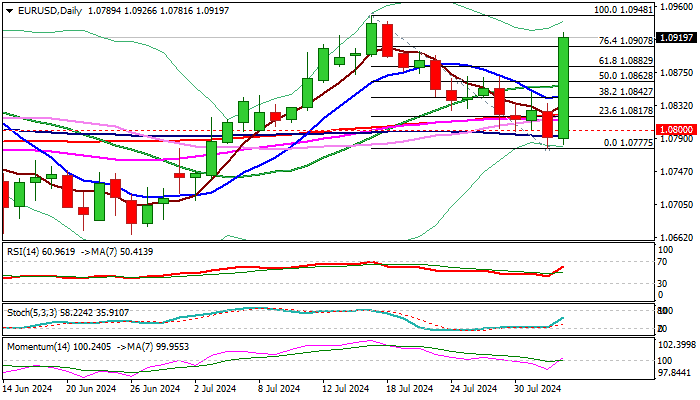

The pair was up 1.2% for the day (the biggest one-day rally since March 2016) and about to fully retrace the bear-leg of past two weeks (1.0948/1.0777) in just one day.

Shocking labor data (NFP hit the lowest since Aug 2021) pushed the dollar lower across the board, as weak labor numbers add to expectations for stronger rate cuts than initially expected.

Strong rally significantly improved technical picture as daily MA’s turned to bullish configuration and 14-d momentum emerged into positive territory, opening prospects for further advance.

Bulls pressure pivotal resistance at 1.0948 (July 17 high) violation of which to expose targets at 1.0981/1.1000 (Mar 8 peak / psychological).

However, strong rally is likely to result in profit-taking which may stall advance under 1.0948 target and keep fresh bulls on hold for consolidation.

Near term bias turned bullish on improved fundamentals, suggesting that consolidation should be limited and downticks to be contained at 1.0870/60 zone, to keep bulls intact.

Res: 1.0926; 1.0948; 1.0981; 1.1000

Sup: 1.0900; 1.0870; 1.0855; 1.0842