EURUSD – Weak German data added to negative outlook as traders expect dovish tone from the ECB on Thursday

The Euro hit new session low at 1.2181 after weak German data added to negative outlook. IFO index fell below expectations in Apr )102.1 vs 102.8 f/c), continuing to deteriorate from January’s peak at 117.6 and signaling that German business morale falls further.

Weak IFO data add to concerns about the message from the ECB on Thursday (CB policy meeting) which is seen as mainly dovish and could further pressure the Euro on the outcome in line with expectations.

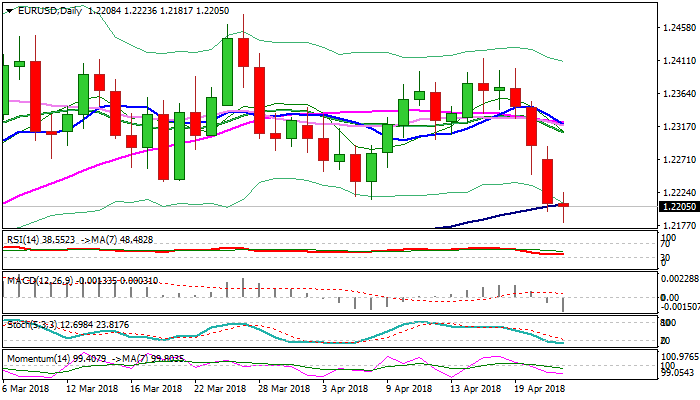

Bears look for negative signal on close below 100SMA (1.2206) and extension through key supports at 1.2172/53 (Fibo 38.2% of 1.1553/1.2555 / low of multi-month 1.2153/1.2555 congestion), firm break of which would generate strong bearish signal for deeper correction of 1.1553/1.2555 rally.

Daily cloud continues to weigh and cloud base (1.2235) is expected to ideally cap corrective upticks.

Res: 1.2206; 1.2235; 1.2290; 1.2308

Sup: 1.2172; 1.2153; 1.2092; 1.2054