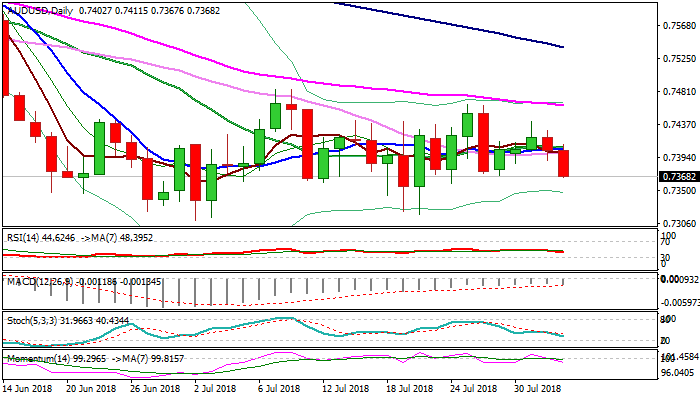

Extended bears pressure key support at 0.7370

The Australian dollar holds firmly in red on Thursday and extends weakness of the previous day, denting key near-term support at 0.7370 (27 July low / Fibo 61.8% of 0.7317/0.7464 upleg).

Upbeat Australian trade balance data (trade surplus widened to A$1.87 B vs A$ 0.9B f/c) had little positive impact on the pair

Rising fears of intensifying US-China trade tensions, keep the Aussie, China’s sentiment liquid proxy, under increased pressure.

Fall of Chinese equities by 2% adds to negative outlook.

Bearish technical studies support the notion as momentum formed bear-cross and broke into negative territory and RSI turned south from neutral zone, as the price broke below a cluster of converged MA’s.

Firm break below 0.7370 pivot would spark fresh weakness and risk retest of key supports at 0.7317/10 (20 / 02 July lows respectively).

Upside attempts should be capped at 0.7400 zone to keep bears intact.

Res: 0.7389; 0.7400; 0.7429; 0.7440

Sup: 0.7359; 0.7343; 0.7317; 0.7310