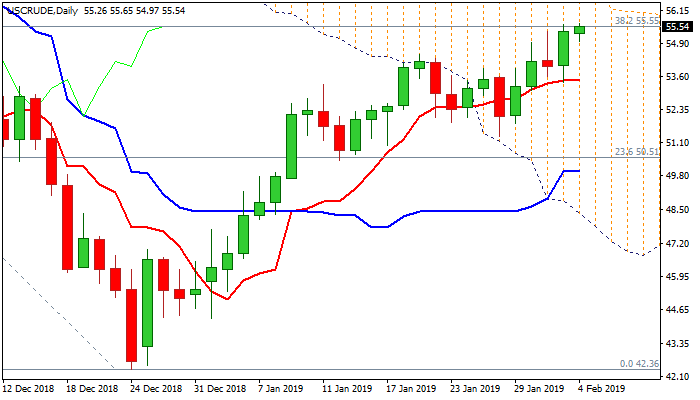

Extended bulls look for clear break above pivotal $55.55 Fibo barrier

WTI oil maintains positive tone on Monday and hit new 2019 high at $55.65 (upper 20-d Bollinger band) on renewed probe through pivotal $55.55 barrier (Fibo 38.2% of Oct/Dec $76.88/$42.36 fall).

Oil advanced 2.4% on Friday, boosted by tighter oil market on US sanctions on Venezuela, with OPEC supply cut and lower number of US oil rigs, adding to positive sentiment.

Sustained break above cracked $55.55 barrier is needed for strong bullish signal and acceleration towards next pivotal barrier at $57.39 (daily cloud top).

Bullishly aligned daily techs are supportive, however, risk of further hesitation at $55.55 pivot cannot be ruled out as slow stochastic is entering overbought territory and bullish momentum is weakening.

Dip-buying scenario could be anticipated while rising 10SMA ($53.64) holds.

Loss of 10SMA support would be initial negative signal, while extension and close below ascending 20SMA ($52.90) would sideline bulls and risk deeper pullback.

Res: 55.65; 56.00; 57.39; 57.56

Sup: 54.97; 54.47; 53.64; 52.90