Extended consolidation awaits for a catalyst to establish in fresh direction

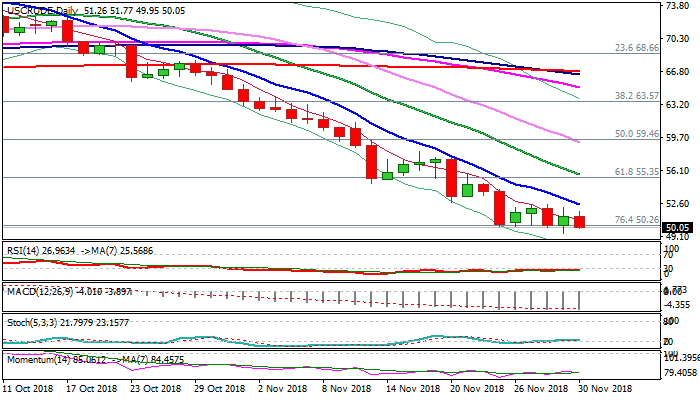

WTI oil stands at the back foot on Friday but holding above psychological $50 support, which was cracked on Thursday’s dip to $49.40.

Failure to eventually close below $50 trigger, kept the price in extended consolidation during this week.

Long-legged Doji is forming on weekly chart and supports signals of strong hesitation at $50 level and directionless mode on mixed key fundamentals.

Oil was in for seven straight weeks steep downtrend, which started showing initial signs of fatigue.

Strong signs of global oversupply and projections for lower global demand in 2019, kept oil price under strong pressure, with fears of further weakness on escalation of trade conflict.

On the other side, signals that OPEC and Russia may reduce an output, with today’s signals that Russia would back the agreement, adding to positive signals.

The upside was so far capped by broken 200WMA ($52.30) with sustained break above needed to generate stronger bullish signal.

An outcome of G20 summit during the weekend is expected to provide stronger direction signal.

Res: 50.87; 51.77; 52.30; 52.53

Sup: 50.00; 49.40; 49.10; 48.58