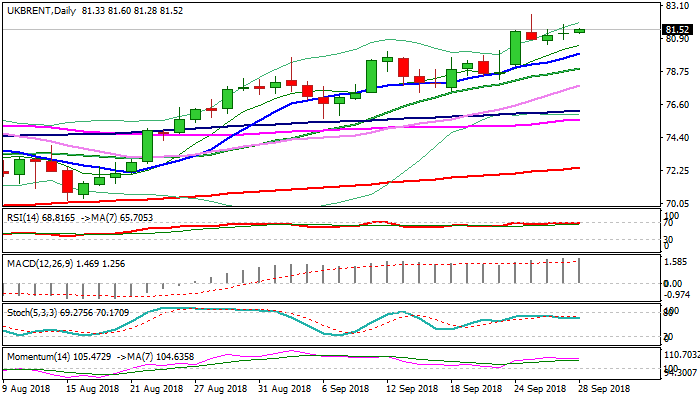

Extended consolidation to precede fresh upside; strong bullish signal on weekly close above $80

Brent oil edged higher in early Friday’s trading, signaling that corrective pullback from new four-year high at $82.53, which found footstep at $80.51, might be over.

Fresh advance is offsetting impact from Thursday’s long-legged Doji candle, with contract being on track for the third consecutive bullish weekly close and looking for strong signal on eventual weekly close above broken psychological $80 barrier after repeated failure in May (spikes to $80.48/47 were short-lived).

Bullish daily techs remain supportive, but sideways-moving momentum suggests the price may hold in extended consolidation before fresh push higher.

Bulls also look for close above next pivotal barrier, cracked Fibo 61.8% of $115.68/$27.09 fall) to generate another strong bullish signal for extension towards $87.92 (29 Oct 2014 high).

Overall sentiment remains bullish, with focus on US sanctions on Iran, but traders are still trying to estimate potential impact to global supply once the sanctions start on Nov 4, with concerns whether OPEC and Russia will be able to cover the gap in supply after Iran will be out.

Consolidation range low at $80.51 marks solid support, guarding $80.00 pivot (reinforced by rising 10SMA) which needs to hold extended dips and keep bulls intact.

Res: 81.87; 82.53; 82.84; 83.00

Sup: 81.28; 80.83; 80.51; 80.00