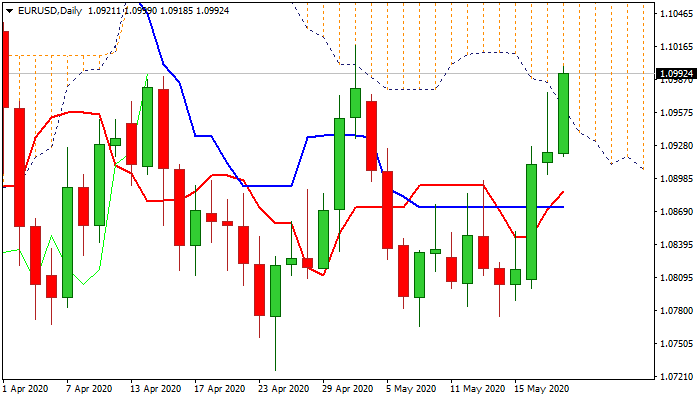

Extended rally penetrated daily cloud and eyes 200DMA

The Euro hit new highest in nearly three weeks on Wednesday as proposal by France and Germany for a common fund increased demand for the single currency, with weaker dollar underpinning the advance.

The pair penetrated thick daily cloud (1.0962/1.1065) and also broke above 100DMA (1.0968) after the bullish action on Tuesday was strongly rejected by falling cloud base.

Bulls ignored warning from Tuesday’s candle with long upper shadow about strong headwinds from resistances provided by daily cloud and 100/200DMA and resumed after pause on Tuesday.

Key barriers at 1.1014/17 (200DMA / 1 May high) are under pressure and firm break here would open way for test of next strong obstacle at 1.1065 (daily cloud top / 50% of 1.1494/1.0635).

On the other side, fading bullish momentum and overbought stochastic on daily chart warn that bulls may take a breather before continuing.

Broken cloud base now marks solid support which should contain downticks and offer better opportunities for-re-entering bullish market.

Only return and close below cloud base would put bulls on hold for deeper pullback

Res: 1.1000; 1.1014; 1.1065; 1.1087

Sup: 1.0962; 1.0929; 1.0902; 1.0869