Extended range trading on mixed signals

The Euro extends choppy directionless trading into fifth straight day, lacking catalyst which could provide fresh direction signal.

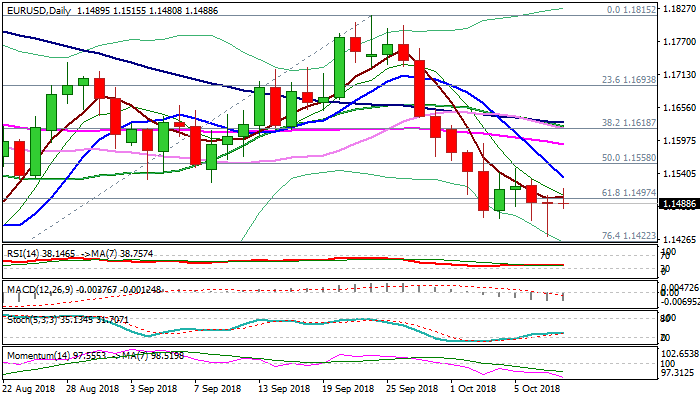

From one side, Tuesday’s long-legged Doji candle (formed after strong downside rejection near Fibo 76.4% target at 1.1422) suggests that larger bears might be running out of steam which could result in short squeeze and fresh attack at daily cloud base (1.1545).

On the other side, rising bearish momentum and multiple bear-crosses of daily MA’s in bearish configuration, signal that larger downtrend from 1.1815 (24 Sep high) is intact and could extend through 1.1422 pivot for possible full retracement of 1.1300/1.1815 ascend.

Expect bullish signals on violation of 1.1534 (falling 10SMA) and 1.1545 (daily cloud base) with confirmation on close above pivotal barrier at 1.1578 (daily cloud top / Fibo 38.2% of 1.1815/1.1432 fall).

Break and close below 1.1422 target would generate negative signal and would unmask key support at 1.1300 (15 Aug low).

Res: 1.1515; 1.1534; 1.1545; 1.1578

Sup: 1.1480; 1.1432; 1.1422; 1.1394