Extended recovery is underpinned by bear-trap but risk of stall exists

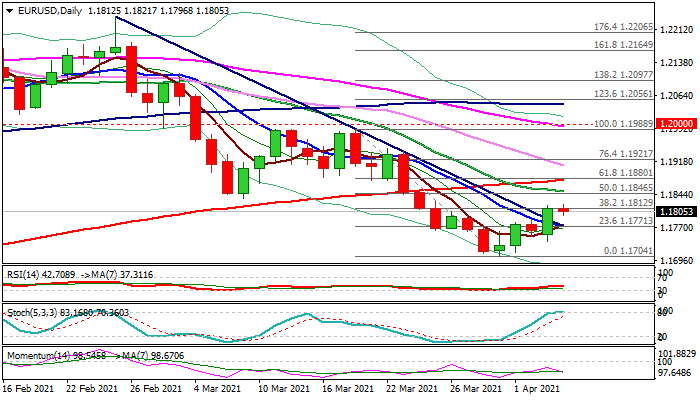

The Euro remains firm in early Tuesday’s trading and probes through pivotal Fibo barrier at 1.1812 (38.2% of 1.1988/1.1704), after 0.5% advance on Monday registered bullish signal on close above 10DMA and trendline resistance.

Formation of bear-trap pattern under 1.1776 Fibo support on daily chart, reinforces bullish bias with formation of 5/10DMA bull-cross additionally underpinning near-term action.

On the other side, momentum on daily chart remains in the negative zone and turned south again while stochastic entered overbought territory that may provide strong headwinds and possibly limit recovery.

Lockdowns across the Europe and so far slow vaccination in the bloc’s countries continue to sour Euro’s sentiment.

Fresh bulls need eventual close above 1.1812 Fibo level to tighten grip and open way towards 20DMA (1.1850) and more significant 200DMA (1.1876).

Caution on repeated failure at 1.1812 that would weaken near-term structure and risk fresh weakness.

Return and close below 1.1774 (10DMA / trendline) would signal an end of corrective phase and shift near-term focus lower.

Res: 1.1821; 1.1835; 1.1850; 1.1876

Sup: 1.1796; 1.1774; 1.1737; 1.1704