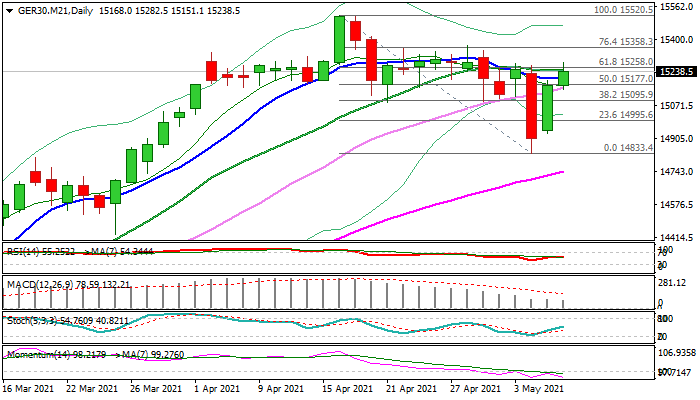

Extended recovery needs clear break of key Fibo barrier to resume

The Dax maintains positive tone and extends recovery from one-week low (14833) into second day.

Fresh risk appetite on hopes of strong economic recovery keep the global stocks resilient, while stronger than expected German data, released earlier today, offered additional support.

Strong rebound fully retraced Tuesday’s 2.1 % drop (the second biggest one-day fall in 2021) sidelining the downside risk, while probe through pivotal barriers at 15246 (20DMA and 15258 (Fibo 61.8% of 15520/14833), signals that corrective pullback from new record high at 15520 might be over.

Daily close above these barriers is needed to confirm bullish signal and open way for further recovery towards lower platform at 15360 (also Fibo 76.4%).

Rising and thickening daily cloud continues to underpin the action, but momentum on daily chart remains negative and sending warning signal.

Caution on failure to clear 15246/15258 pivots, however near-term action is expected to remain biased higher while holding above 15177 (broken Fibo 50% of 15520/14833).

Return and close below 15100 (daily Tenkan-sen / broken Fibo 38.2%) would signal recovery stall and bring bears back to play.

Res: 15282; 15360; 15414; 15520

Sup: 15177; 15100; 14995; 14929