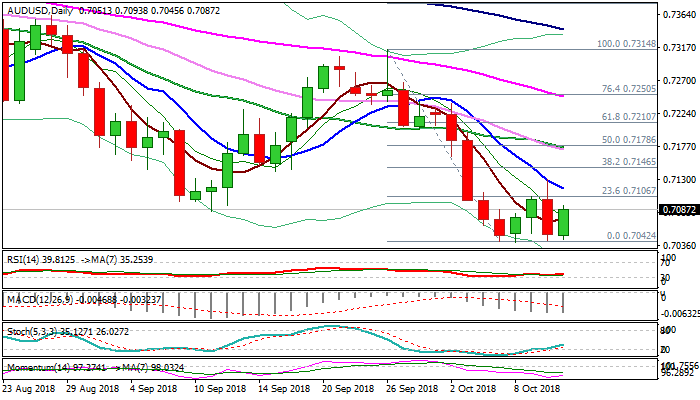

Extended sideways mode between 0.7042 base and falling 10SMA

The Aussie dollar holds within congestion above multiple lows 0.7042, where temporary base has formed, with limited upside, capped by falling 10SMA, keeping the pair in the range.

Wednesday’s steep fall reversed gains of previous two days and was contained at 0.7042, confirming the significance of the support.

Fresh recovery is under way today, but still away from pivotal barriers at 0.7105 (Tuesday’s high) and 0.7130 (Wednesday’s spike high), break of which is needed to ease downside risk and signal recovery extension towards next key barrier at 0.7145 (Fibo 38.2% of 0.7314/0.7042 fall).

Daily slow stochastic is moving higher after reversal from oversold territory and supports the notion along with north-turning momentum.

Extended sideways mode with vulnerable downside could be expected while the price action stays capped by 10SMA (0.7116).

US inflation data today could provide fresh direction signals. Eventual break below 0.7042 base would expose next strong bids at 0.70 and signal extension of bear-leg from 0.7314 (26 Sep high).

Conversely, sustained break above 10SMA and Fibo barrier at 0.7146 is needed to confirm base and open way for stronger correction of 0.7314/0.7042 descend.

Res: 0.7105; 0.7116; 0.7130; 0.7145

Sup: 0.7042; 0.7000; 0.6974; 0.6906