Bearish sentiment favors further downside; crude inventories report eyed for signal

Brent price holds in red for the second day and hit two-week low at $81.13 on Thursday.

Strong fall in US stocks affected oil prices, already pressured by rising fears of the impact of Hurricane Michael, the strongest storm that hit the US coast and significantly reduced demand for oil.

Persisting concerns about US – China trade conflict and unexpected, much stronger than expected build in US crude stocks (API report on Wednesday showed build of 9.75 million barrels, compared to forecasted increase of 0.90 million barrels) add to negative outlook.

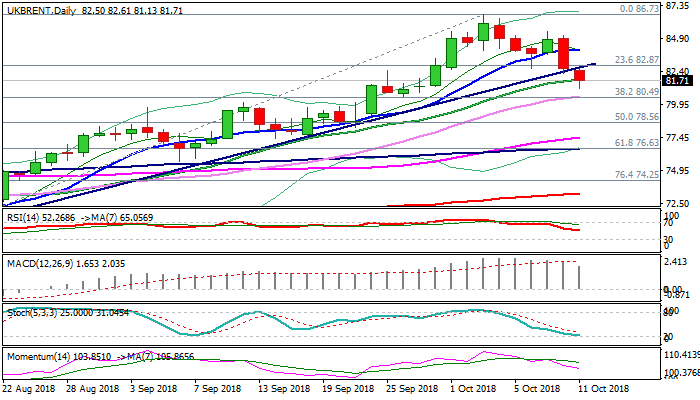

Weaker techs on break below trendline support at $82.76 and completion of failure swing pattern on daily chart, continue to weigh.

Bears cracked support at $81.82 (20SMA) and look for test of key near-term support at $80.49 (Fibo 38.2% of $70.39/$86.73, reinforced by rising 30SMA), loss of which would signal further weakness.

Focus turns towards release of EIA US Crude inventories report, due later today, which would further accelerate bears on surprise (2.62 million barrels draw is forecasted vs last week’s drop of 7.97 million barrels).

Res: 81.82; 82.68; 84.02; 85.15

Sup: 81.13; 80.49; 80.00; 79.16