Extended weakness eyes daily cloud top; UK retail sales / Brexit talks in focus

Cable holds in red for the second consecutive day and extends previous day’s 0.51% fall, driven by UK inflation miss and weakness of the Euro.

In addition, hawkish tone from minutes of Fed’s Sep meeting, which confirmed that the central bank remains on path for more rate hikes, inflated dollar, increasing pressure on pound.

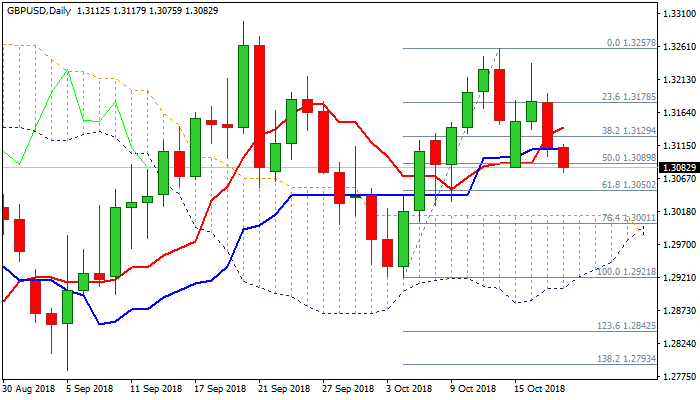

Bears probed below key near-term supports at 1.3089/83 (50% retracement of 1.2921/1.3257 upleg / Monday’s low), with firm break here to open way towards 1.3050 pivot (Fibo 61.8%) and 1.3012/00 (daily cloud top / psychological support), as daily cloud twists next week and could attract bears.

Daily MA’s are turning to bearish configuration, with 5/10SMA bear-cross seen as initial negative signal, but momentum is flat at the midline and lacking signal for now.

Negative near-term sentiment favors further downside, with focus on UK retail sales data release.

Forecasts for September are negative (m/m -0.4% f/c vs 0.3% prev / core m/m -0.4% f/c vs 0.3% prev) and could further pressure sterling on release at / below consensus.

UK PM May told EU leaders that Brexit deal can still be reached despite talks stalled over the weekend on conflict over Irish border and received positive respond.

Markets continue to closely watch Brexit talks and look for fresh signals.

Res: 1.3099; 1.3117; 1.3143; 1.3192

Sup: 1.3075; 1.3050; 1.3012; 1.3000