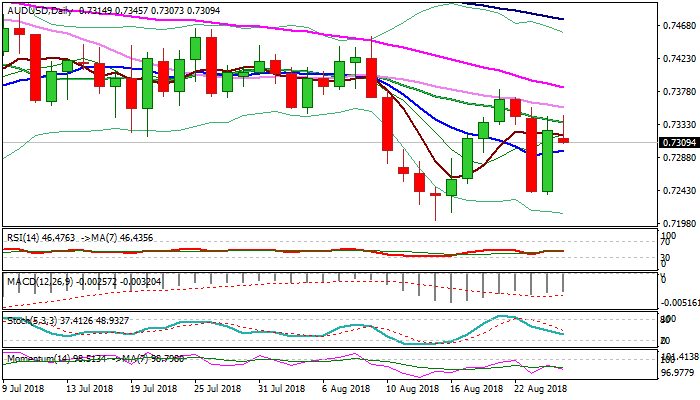

Falling 20SMA continues to cap; 10SMA marks key support

Attempts to extend Friday’s strong recovery rally were repeatedly capped by falling 20SMA on Monday, but the pair keeps bid on renewed risk appetite.

Daily MA’s are mixed but weakening momentum and south-heading slow stochastic keep the downside at risk, as descending thick daily cloud continues to weigh.

North-turning 10SMA marks pivotal support at 0.7298 and sustained break here would weaken near-term structure and risk retest of 23/24 Aug double-bottom at 0.7240.

Bullish scenario requires close above 20SMA to generate initial bullish signal for extension towards key barriers at 0.7381/83/88 (21 Aug high / falling 55SMA / daily cloud base).

Res: 0.7336; 0.7357; 0.7388; 0.7436

Sup: 0.7297; 0.7252; 0.7240; 0.7202