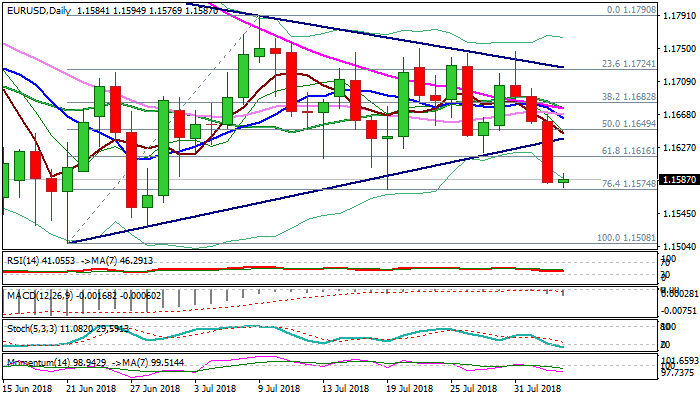

Firm bearish stance after eventual break below triangle support; US jobs data in focus

The Euro holds in red for the fourth consecutive day, with fresh extension of Thursday’s strong fall on Friday, pressuring support at 1.1574 (19 July spike low).

Firm dollar on US/China trade war worries keep the Euro under increased pressure, which resulted in eventual break and close below triangle support, ending multi-week narrowing consolidation.

Thursday’s close below triangle support line (1.1633) and Fibo support at 1.1616 (61.8% of 1.1508/1.1790) were strong bearish signals.

Bearish studies on daily chart (MA’s in full bearish setup; growing negative momentum and strong pressure from thick daily cloud) support bearish scenario which could result in re-visiting key short-term support at 1.1508 (21 June low).

Meanwhile, the pair may move higher, in positioning ahead of key data, with broken triangle support line marking strong barrier, where upticks are expected to face strong headwinds.

US jobs data, due later today, are in focus, with releases in line with forecasts or better, expected to further boost the greenback and depress the single currency.

Forecasts for July show that US companies kept strong trend in hiring (193K vs 213K in June), with unemployment rate expected to fall to 3.9% from 4.0% and come closer to 18-year low of 3.8% (hit in May) and forecast for rise in average hourly earnings (0.3% f/c vs 0.2% prev).

Solid numbers today would confirm further tightening in labor market and signal that the US economy is getting more robust, which would pave way for rate hike in September.

Res: 1.1616; 1.1633; 1.1662; 1.1675

Sup: 1.1574; 1.1527; 1.1508; 1.1447