Trade tensions keep metal’s price firmly in red

Copper extends strong fall of the previous day to new two-week low at $2.7060 on Thursday, as fears of escalation of trade tensions between the US and China, metal’s biggest consumer, keep the price firmly in red.

On the other side, news about a strike in the biggest copper mine in Chile, did little to support the metal’s price.

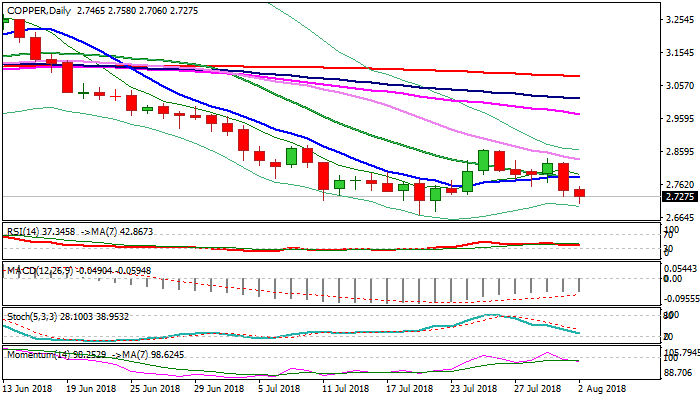

Fresh bearish extension approached psychological $2.70 support, the last obstacle en-route to key support at $2.6720 (19 July low, the lowest since July 2017), violation of which would signal extension towards $2.6280 (50% retracement of $1.9360/$3.3200, Jan 2016/Dec 2017 rally).

Bearish daily techs add to negative outlook, with converged 10/20SMA’s ($2.7839) marking solid barrier and expected to cap upticks.

Res: 2.7580; 2.7839; 2.8270; 2.8369

Sup: 2.7060; 2.7000; 2.6720; 2.6280