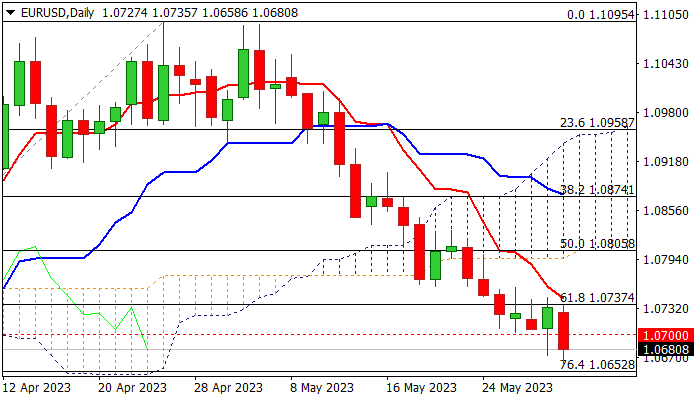

Firm break of psychological 1.07 support to open way for further weakness

The Euro came under renewed pressure and fell to new nine-week low on Wednesday, bringing larger bears back to play after brief consolidation above 1.07 support.

Fresh weakness so far shapes Wednesday’s action in large bearish candle, which is on track to offset initial reversal signal on Monday’s inverted hammer and Tuesday’s bullish candle, along with false break below 1.07.

Today’s close below 1.07 level would add to fresh signals of bearish continuation, with violation of nearby Fibo support at 1.0652 (76.4% of 1.0516/1.1095) to open way for possible full retracement of 1.0516/1.1095 rally.

Bearish daily studies contribute to negative near-term outlook, though caution is still required, as repeated failure to register close below 1.07 mark would signal prolonged consolidation.

Immediate bears are expected to remain fully in play while falling daily Tenkan-sen (1.0744) caps, while break higher would ease downside pressure and open door for bounce towards strong barrier at 1.0805 (base of thick daily Ichimoku cloud).

Res: 1.0700; 1.0744; 1.0759; 1.0805

Sup: 1.0652; 1.0631; 1.0600; 1.0551