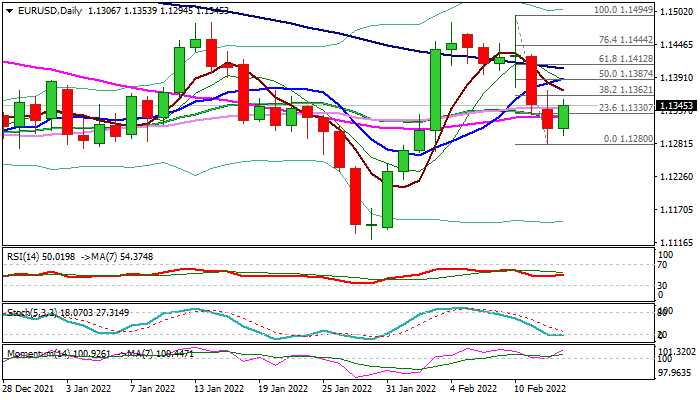

Fresh advance on renewed risk appetite needs to clear key obstacles at 1.1350 zone to resume

Steep fall in past two days is pausing as fresh bulls emerged on optimistic news from Ukraine that revived risk sentiment and lifted the Euro in European session on Tuesday.

Today’s economic data from the EU came mainly in line expectations, adding to positive tone.

Fresh bulls pressure key double-Fibo barriers at 1.1350 zone (broken 38.2% of 1.1121/1.1494 upleg and 38.2% of 1.1494/1.1280 pullback), with sustained break here needed to generate bullish signal and open way for further advance.

Daily studies are gaining bullish momentum and RSI is heading north, while daily cloud is thinning and next week’s twist also expected to attract.

Clear break of 1.1350 zone would expose next pivotal barriers at 1.1387 and 1.1412 (Fibo 50% and 61.8% of 1.1494/1.1280 respectively), violation of which would confirm a higher low at 1.1280 (Feb 14).

Caution on failure to clear 1.1350 pivot tat would keep the downside vulnerable, but return and close below pivotal 1.1300 zone is needed to bring bears fully in play.

Situation over Ukraine is expected to dominate and remain a key market driver, with further improvement to keep riskier assets supported.

Res: 1.1353; 1.1362; 1.1387; 1.1412

Sup: 1.1300; 1.1280; 1.1264; 1.1221