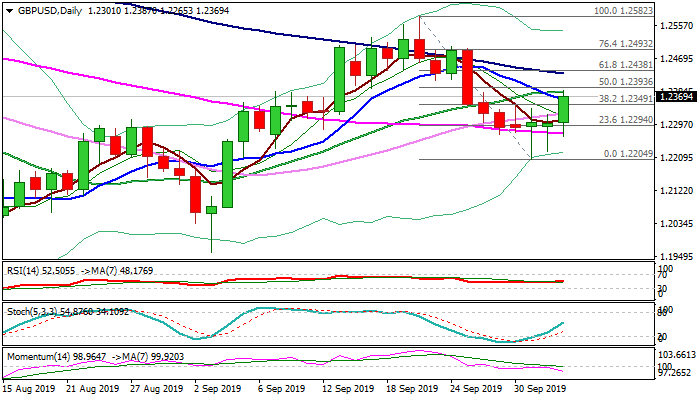

Fresh advance signals possible break of four-day congestion

Cable accelerated higher in early US trading on Thursday, signaling possible break of four-day congestion, after long-tailed candles of past two days added to idea of bears’ stall.

Fresh advance broke above Fibo barrier at 1.2349 (38.2% of 1.2582/1.2204) and extended above 10DMA (1.2361), but faced headwinds from 20DMA (1.2383) which limits fresh bulls for now.

Initial bullish signal has been generated, but close above 1.2349 Fibo barrier is minimum requirement to confirm scenario and keep near-term focus at the upside.

Lift above 20DMA and violation of more significant daily cloud top (1.2399) is needed to confirm reversal and expose target at 1.2438 (Fibo 61.8% of 1.2582/1.2204).

Failure to close above 1.2349 pivot would soften near-term structure and keep the downside vulnerable.

Res: 1.2383; 1.2399; 1.2426; 1.2438

Sup: 1.2349; 1.2324; 1.2308; 1.2294