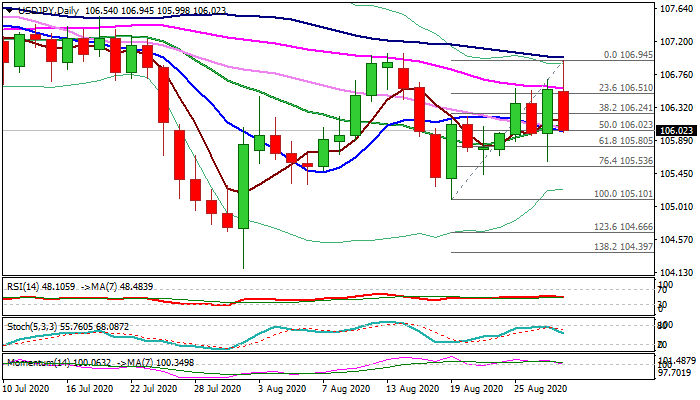

Fresh bearish acceleration emerges after strong rejection at key 107 resistance zone

The pair fell sharply in Asia / early Europe on Friday (down 0.5%), following strong rejection on pivotal 107.00 resistance zone (13 Aug high / falling 100DMA / base of thick falling daily cloud / 50% retracement of 109.85/104.18 fall).

Fresh selling of dollar after Powell unveiled new Fed’s inflation strategy and news of resignation of Japanese PM Shinzo Abe contributed to today’s action.

Bears so far retraced 50% of 105.10/16.94 upleg, shifting near-term focus lower, with scenario requiring confirmation on today’s close below 106 level (10DMA / 50% retracement).

Daily momentum is about to break into negative territory, RSI and stochastic are heading south and MA’s turned to bearish setup, supporting the notion.

Extension below next pivotal levels at 105.80/60 (Fibo 61.8% of 105.10/106.94 / Thursday’s spike low) is needed to confirm reversal and expose key near-term support at 105.10 (19 Aug low).

Res: 106.24; 106.51; 106.69; 107.00

Sup: 105.80; 105.60; 105.53; 105.10