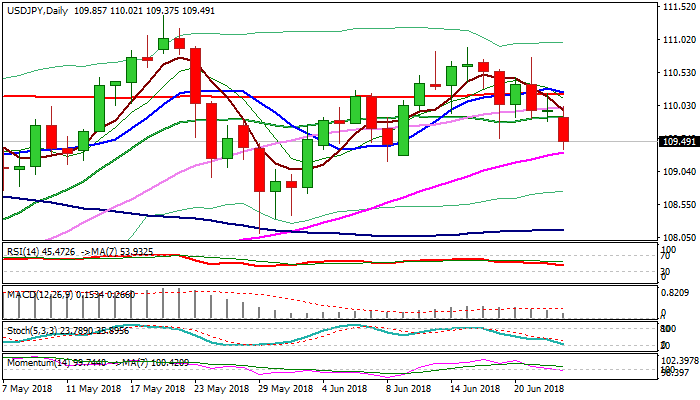

Fresh bearish signal on close below daily cloud top / Fibo 50% at 108.50/46

The pair dipped further on Monday as risk aversion on trade war concerns keeps the greenback under pressure.

Fresh weakness probed below key supports at 108.50/46 (Fibo 50% of 108.11/110.90 upleg / top of rising daily cloud), close below which would generate strong bearish signal for further weakness.

Bearish configuration of daily MA’s with multiple bearish crosses and 14-d momentum breaking into negative territory, support scenario.

Close within daily cloud would risk test of next pivot at 109.17 (Fibo 61.8% / 08 June trough) and open way for further weakness on break.

Conversely, bounce and close above 20SMA (109.86) would sideline immediate downside risk, while close above 200SMA (110.23) would bring bulls back to play.

Res: 109.86; 110.00; 110.23; 110.75

Sup: 109.37; 109.17; 108.77; 108.38